What is Prudent Asset Allocation?

Prudent Asset Allocation (“PAA”) is an overarching investment strategy that separates investors assets into two channels and manages the movement from one to the other in a way that maximizes the safety of the first channel and maximizes return in the second. In this way investors earn as much as is feasible without putting their wellbeing at risk.

Prudent Asset Allocation: The Preservative Component

The first channel is called the Preservative component and contains assets needed to fund present and short term future expenditures. Assets in the Preservative component are allocated to each of the next five years and used to fund ongoing expenses, planned purchases, emergencies and other spending in those years.

In the event that the Preservative component for one year is exhausted, “loans” can be taken from succeeding years. In this way, unexpected situations are immediately covered and the “loans” repaid by withdrawals from the Growth component when market conditions are favorable.

The Preservative component uses payment instruments and investments that can be converted into payment instruments with no penalties or delays.

Prudent Asset Allocation: Growth Component

The second channel is called the Growth component and maximizes investment return on assets that will not be needed in the short term. When the planned need to use the Growth component is within five years, a gradual shift is begun into the Conservative component.

The Growth component is invested in a diversified portfolio that can reasonably be expected to appreciate in value over the time until the assets are needed. Historical data shows that the worst broad equity markets (S&P 500) recover within five years. Investors can expect that unfavorable markets could last that long.

While highly speculative investments are not advised, there are no restrictions as to the types of assets that can be used. The keys to Growth investment selection are:

- A robust history of high returns

- Proven ability to recover from declines

- Diversified investments to avoid concentration risk

Prudent Asset Allocation Benefits

The key benefits of PAA are:

- A balance of Preservative and Growth components that is specific to investors current situation.

- Elimination of concerns of making ends meet.

- Elimination of fears of market ups and downs.

- Maximum return on long term assets.

- Continuously adapting to changes in personal situation and investment markets.

- Ability to always wait for market recovery before making withdrawals

Prudent Asset Allocation Case Study

Abstract

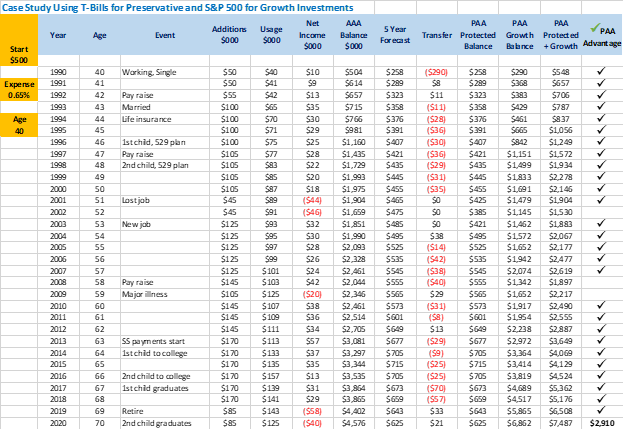

The principles of Prudent Asset Allocation were applied to determine the effects in real-life situations. The period covered was 1990 to 2020 during which time the subject started at age 40 with investments of $500,000.

PAA Case Study Highlights

The results after actual market activity and a variety of life changing events showed the following ending balances (in thousands):

- Arbitrary Asset Allocation ($000) $4,576

- Prudent Asset Allocation ($000) $7,486

Assumptions Used

Assumed Allocations

For the AAA method, a 60/40 allocation (60% Growth and 40% Conservative) is used when the investor is 40 years old. This changes to be more conservative by 10% each decade. At age 50 the allocation changes to 50/50, and at age 60 to 40/60, etc.

For the PAA method, the Preservative investment is the amount needed to cover forecasted usage for the following five years, except when market conditions are unfavorable. All remaining assets are held in the Growth investment.

Investments

All Conservative (AAA) and Preservative (PAA) assets are held in Treasury Bills.

All Aggressive (AAA) and Growth (PAA) assets are held in the S&P 500.

Expenses

Expenses for Treasury Bills are zero.

Expenses for S&P 500 are 0.65% (65 basis points)

Events

The following events and corresponding financial consequences are introduced in the case study:

|

Pay raise |

Increase in gross pay with no increase is use of funds |

|

Married |

Working spouse increases both use of funds and gross pay |

|

Life insurance |

Covers additional obligation at a modest increase in use of funds |

|

Child born |

A 529 plan is started at a modest increase in use of funds |

|

Lost job |

Gross pay for one spouse stops but use of funds continues |

|

New job |

Gross pay is restored at a higher level after two years |

|

Major illness |

Gross pay suspended for one spouse; health care cost covered by insurance |

|

SS payments start |

Social security is added to investor’s income |

|

Child goes to college |

Costs are supplemented by 529 plan |

|

Child graduates |

This use of funds ends |

|

Retire |

Anticipation of income needs begins five years before with transfers from Growth investments when favorable market conditions exist. |

Notable Observations

Unfavorable Market Activity

There were four periods of unfavorable market conditions

- 1990

- 2000 – 2002

- 2008

- 2018

The only case where this coincided with a need to withdraw from the market was the period 2001 - 2002. Withdrawals were suspended until 2004 and there were more than sufficient funds in the Protective investments to permit waiting until the market value was fully restored.

When AAA beat PAA

PAA produced superior returns to AAA in 28 of the 31 years of the case study. The three cases where AAA exceeded the PAA returns were:

- 2002 when one spouse lost his/her job while market conditions were unfavorable

- 2008 when there was a severe market decline

- 2009 when one spouse suffered serious illness

Variations Available

This case study was developed using an intelligent computer model that permits unlimited scenarios (Try the PAA Worksheet AI Calculator).

DALBAR will conduct variations of this case study to reflect specific situations.

Typical variations include:

- Starting Balance

- Expense Ratio

- Age

- Additions & Usage of Funds

- Assumed Arbitrary Allocations

- Events, Timing and Impact of Events

- Investments Used

- Time Period Covered

- Forecast Period

The following table details the market conditions, assumed events and their effects in the case study.

%20(1)-1.png)

%20(1).png)

SUBMIT YOUR COMMENT