Introduction

Fiduciaries of Employer Sponsored ERISA Retirement Plans (“Plans”) have the duty to act in the best interest of Plan participants and this duty includes ensuring that compensation paid to service providers by participants (“Compensation”) is reasonable in relation to the services provided. The current practice has been to reduce this fiduciary requirement to a simplistic and irrational belief.

The belief is that plans are sufficiently alike so that the computation of the average Compensation paid by similar size plans can be used to determine what Compensation is reasonable.

This belief contradicts the basic economics of revenue and costs. The belief also assumes that all participants in all Plans demand the same mix of services, same quality, same automation/technology, same education, same advice, etc.

In contrast, this paper uses basic economics to illustrate the factors that must be considered in assessing probability of Compensation being excessive. These factors can be used to calculate a “Target Price” that represents the Compensation that covers the cost of providing services to a specific Plan.

It is a fundamental premise of this analysis that the method of determining Compensation is relevant only in assessing potential conflicts of interest and has no bearing on whether the Compensation paid is excessive.

Compensation

Compensation is usually based on some combination of the following determinants:

- Allocation of Assets… based on participant investment election

- Plan Default Alternative… selected by Plan Fiduciary

- Share Class… applicable to investment companies that offer multiple classes and selected by Plan Fiduciary

- Per Capita Fees… when service provider offers this alternative

- Paid Directly by Participant

- Negotiated Fees… any other arrangements

Of these, the most widely used is Allocation of Assets in combination with a selected Share Class. Plan Fiduciaries have control over Asset Allocation decisions only in the case of Qualified Default Investment Alternatives. Plan fees are most often divided among various providers based on agreements that are independent of the Plan or its fiduciaries (bundled). There are other cases where Plan Fiduciaries are party to individual service arrangements (unbundled).

Servicing Costs

Contrary to general economic practice, the costs of servicing seldom have direct bearing on the fees charged to the Plan or its participants. The costs, however, determine the viability of the service provider.

The economic practice is for a service provider to reject arrangements that are not projected to generate sufficient fees. On the other hand, highly profitable arrangements (“excessive fees”) can be determined from factors that determine compensation, increase costs, or reduce them.

Cost Determinants

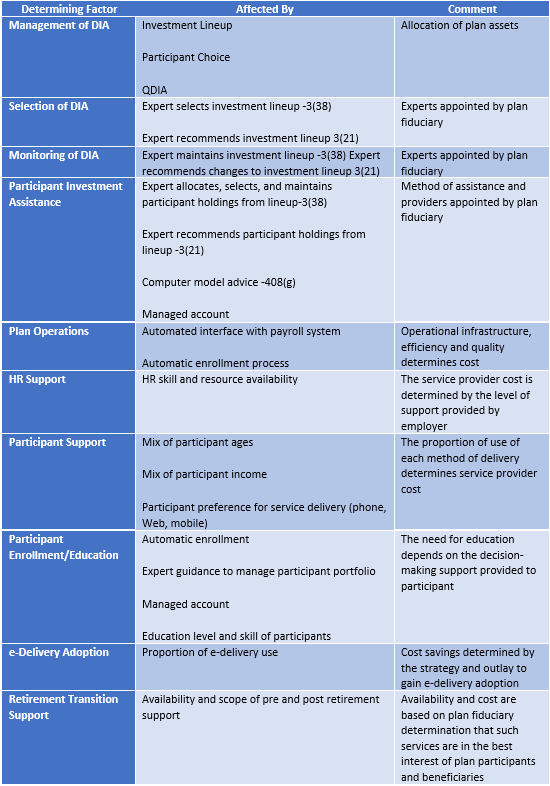

The table below shows the typical factors that determine a service provider’s costs and lead to a determination of a Target Price.

%20(1)-1.png)

%20(1).png)

SUBMIT YOUR COMMENT