What is Prudent Asset Allocation?

Prudent Asset Allocation (“PAA”) is an overarching investment strategy that separates investors assets into two channels and manages the movement from one to the other in a way that maximizes the safety of the first channel and maximizes return in the second. In this way investors earn as much as is feasible without putting their wellbeing at risk.

Prudent Asset Allocation: The Preservative Component

The first channel is called the Preservative component and contains assets needed to fund present and short term future expenditures. Assets in the Preservative component are allocated to each of the next five years and used to fund ongoing expenses, planned purchases, emergencies and other spending in those years.

In the event that the Preservative component for one year is exhausted, “loans” can be taken from succeeding years. In this way, unexpected situations are immediately covered and the “loans” repaid by withdrawals from the Growth component when market conditions are favorable.

The Preservative component uses payment instruments and investments that can be converted into payment instruments with no penalties or delays.

Prudent Asset Allocation: Growth Component

The second channel is called the Growth component and maximizes investment return on assets that will not be needed in the short term. When the planned need to use the Growth component is within five years, a gradual shift is begun into the Conservative component.

The Growth component is invested in a diversified portfolio that can reasonably be expected to appreciate in value over the time until the assets are needed. Historical data shows that the worst broad equity markets (S&P 500) recover within five years. Investors can expect that unfavorable markets could last that long.

While highly speculative investments are not advised, there are no restrictions as to the types of assets that can be used. The keys to Growth investment selection are:

- A robust history of high returns

- Proven ability to recover from declines

- Diversified investments to avoid concentration risk

Prudent Asset Allocation Benefits

The key benefits of PAA are:

- A balance of Preservative and Growth components that is specific to investors current situation.

- Elimination of concerns of making ends meet.

- Elimination of fears of market ups and downs.

- Maximum return on long term assets.

- Continuously adapting to changes in personal situation and investment markets.

- Ability to always wait for market recovery before making withdrawals

Download The Ultimate Guide to Prudent Asset Allocation eBook

Source of Confidence

Confidence in the securities markets is achieved by a clear understanding of what aspects and conditions merit confidence. The securities markets vary widely in the potential return, risks and the irrational relation between the two. It is therefore necessary to limit exposure to only the most predictable investments and the realistic threats.

This brief will limit its examination to investments with a proven history of reliability and address those risks that have a reasonable likelihood of repetition. While conjecture can lead to millions of possibilities, the boundaries are events that have occurred within the United States during the modern era[1].

Learning from Experience

The S&P 500 was selected as the model for this evaluation because it is the most credible index of the performance of major US equities and has sufficient history to reflect the best of times and the worst of times.

The actual experience since 1940 covers a wide range of conditions that have tested the predictable securities markets. The responses to these threats have been highly consistent and create the foundation of PAA to take maximum advantage of an enormous growth potential while avoiding the potential risks.

The Consistent Pattern

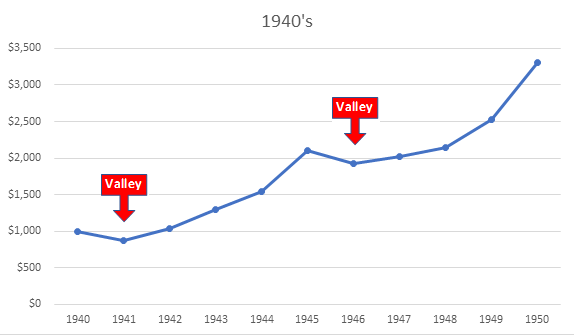

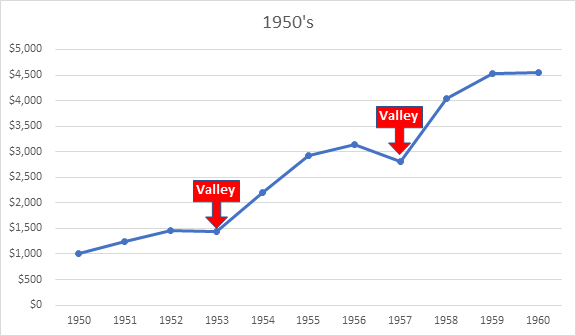

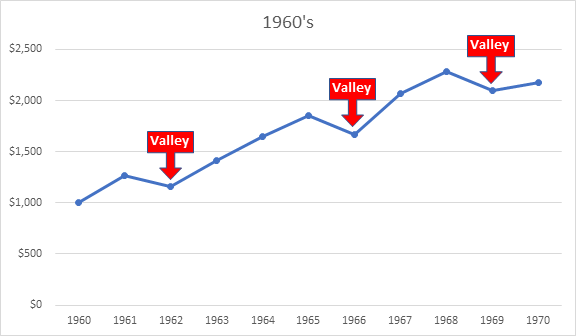

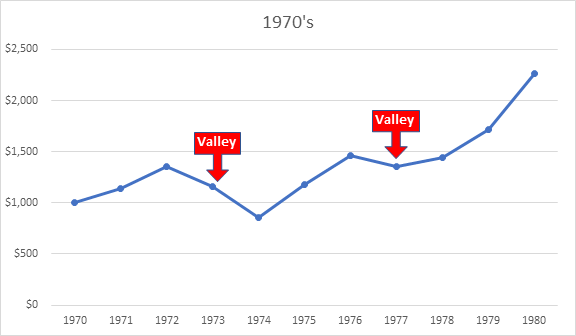

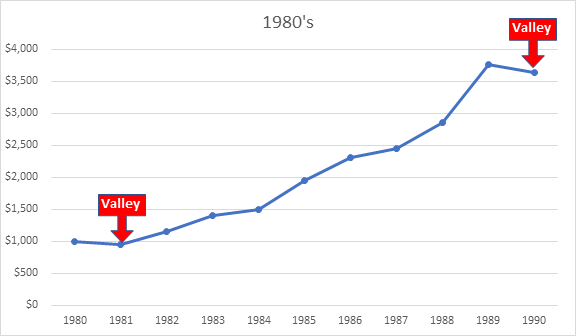

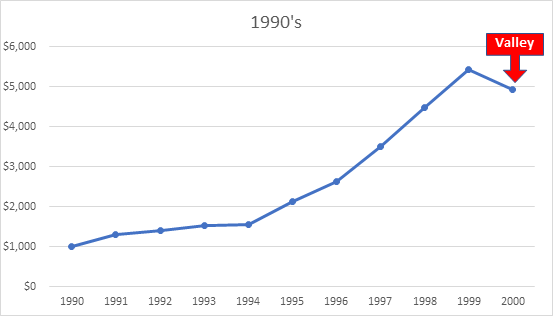

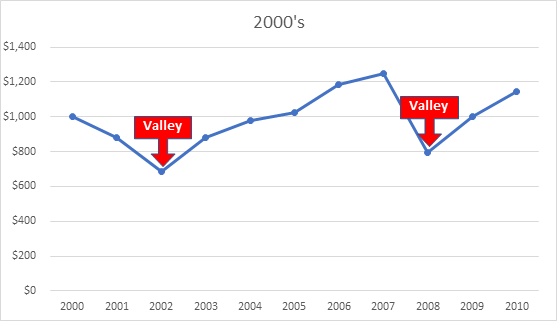

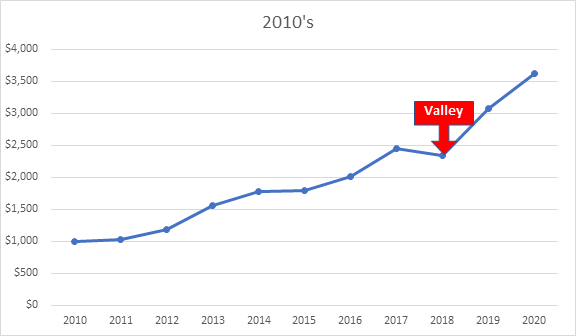

The investment returns of a $1,000 investment in the S&P 500[2] each decade since 1940 was examined separately and findings were that:

- Every decade, regardless of the events that occurred produced positive returns.

- Market declines were recovered within five years.

- The only investors that had negative returns are those who withdrew from the market before the market had recovered, that is “in the valleys”.

It is therefor evident that if investors did not withdraw during the valleys, no investor would suffer losses!

Three key requirements to avoid valley withdrawals are:

- Investor must have the confidence that the market will recover. This confidence can be developed from the decade by decade analysis presented in this brief.

- Investor must have an alternative source of funds until the market is recovered. This is achieved by preserving the funds needed to meet spending in investments that are not subject to fluctuations in value.

- Investor must be diligent to check if investments are in a valley and take steps to avoid the withdrawal.

Decade by Decade Performance

The following table shows the value of a $1,000 investment made at the start of each decade from 1940’s to 2010’s. In spite of major world and financial events, each decade had positive returns. Note that these results reflect the political, regulatory, economic and structural environment in the United States and uses a highly diversified investment portfolio with a limited number of holdings (S&P 500).

|

Ending Value of S&P 500 Investment of $1,000 Held for the Decade |

|||||||

|

1940's |

1950's |

1960's |

1970's |

1980's |

1990's |

2000's |

2010's |

|

$3,312 |

$4,540 |

$2,175 |

$2,260 |

$3,642 |

$4,932 |

$1,147 |

$3,628 |

Valleys of Performance

The following charts show the periods during which withdrawals would result in actual losses for investors. Withdrawals should be avoided until the valley ends. The start of the valley is indicated when the investment return for the previous year is negative. The end of the valley is indicated when the value of the investment recovers to the previous high point.

Notable Events of 1940s

- 1939 – 1945: World War II

- 1940: Investment Companies and Investment Advisers laws enacted.

Notable Events of 1950’s

- Post war boom

- Korean war

Notable Events of 1960’s

- 1963: Kennedy Assassination

- Viet Nam war

Notable Events of 1970’s

- 1973: Middle East Oil crisis

- Stagflation and double digit interest rates

Notable Events of 1980’s

- 1981: Lowered taxes and interest rates

- 1987: Market crash

Notable Events of 1990s

- 1990: The Internet is Born

- Fall of Berlin Wall and Soviet Union

Notable Events of 2000’s

- 2000: Tech Wreck & Dot Com Bubble

- 9/11 Attacks

- 2008: Financial Crisis

Notable Events of 2010s

- 2011: Occupy Wall Street protests

- Historically low interest rates and low inflation

Conclusions

The evidence from the entire modern era inspires caution and confidence. The prudent use of investments to protect and grow holdings requires two concurrent strategies:

- Preservative… for assets that are needed for short term expenditures. These assets are explicitly designed to maintain their value in good and bad economic times and as a consequence earn very low returns.

- Growth… for all remaining assets. These are held in securities that have proven long term records of returns that include downturns and recovery from those downturns.

Essential to the success of this prudent approach is ongoing forecasting of short term expenditures and a reasonable provision for unplanned needs. Forecasts are adjusted regularly to ensure that expenditures for at least five years are covered by a combination of expected income and Preservative assets.

Application of Experience

The PAA Worksheet is a tool that assists in the forecasting of expenditures and projects the adequacy of Growth assets to support the long term needs.

[1] The modern era used in this brief is the period from 1940 to date during which the foundations of the economy and securities markets have been in place. These include the US Constitution, laws, regulations and business structures and practices.

[2] For the period before 1957, a composite was used that reflected S&P performance, had the index existed.

%20(1)-1.png)

%20(1).png)

SUBMIT YOUR COMMENT