What is Prudent Asset Allocation?

Prudent Asset Allocation (“PAA”) is an overarching investment strategy that separates investors assets into two channels and manages the movement from one to the other in a way that maximizes the safety of the first channel and maximizes return in the second. In this way investors earn as much as is feasible without putting their wellbeing at risk.

Prudent Asset Allocation: The Preservative Component

The first channel is called the Preservative component and contains assets needed to fund present and short term future expenditures. Assets in the Preservative component are allocated to each of the next five years and used to fund ongoing expenses, planned purchases, emergencies and other spending in those years.

In the event that the Preservative component for one year is exhausted, “loans” can be taken from succeeding years. In this way, unexpected situations are immediately covered and the “loans” repaid by withdrawals from the Growth component when market conditions are favorable.

The Preservative component uses payment instruments and investments that can be converted into payment instruments with no penalties or delays.

Prudent Asset Allocation: Growth Component

The second channel is called the Growth component and maximizes investment return on assets that will not be needed in the short term. When the planned need to use the Growth component is within five years, a gradual shift is begun into the Conservative component.

The Growth component is invested in a diversified portfolio that can reasonably be expected to appreciate in value over the time until the assets are needed. Historical data shows that the worst broad equity markets (S&P 500) recover within five years. Investors can expect that unfavorable markets could last that long.

While highly speculative investments are not advised, there are no restrictions as to the types of assets that can be used. The keys to Growth investment selection are:

- A robust history of high returns

- Proven ability to recover from declines

- Diversified investments to avoid concentration risk

Prudent Asset Allocation Benefits

The key benefits of PAA are:

- A balance of Preservative and Growth components that is specific to investors current situation.

- Elimination of concerns of making ends meet.

- Elimination of fears of market ups and downs.

- Maximum return on long term assets.

- Continuously adapting to changes in personal situation and investment markets.

- Ability to always wait for market recovery before making withdrawals

Download The Ultimate Guide to Prudent Asset Allocation eBook

Making Retirement Funds Work for You

In this brief we demonstrate the most reliable method of using your retirement funds to continue to produce the maximum feasible returns while also making sure that there are always funds for living expenses, planned purchases, emergencies and other spending.

At retirement, when the usual income is reduced or ceases entirely, that shortfall is covered by withdrawals from the Growth component. To avoid market risk, withdrawals begin five years before the funds are needed.

Retirement Scenario

While every case is different, the following situation is presented as an example.

The Fontuli family consists of a husband (age 70) and wife (age 65) and both intend to retire in three years. Their financial circumstances are:

- There are no dependent children or other family members.

- They live in a home with no mortgage and intend to sell this and purchase a home in a retirement community. The estimated value of the home is $750,000 and the retirement home will cost $600,000.

- Current real estate taxes are $3,000.

- They have a joint investment account valued at $450,000 and $85,000 in checking and savings accounts. The joint investment account is aggressively invested in equities.

- Taxable income from investments is $80,000 with income and capital gains taxes of $12,000.

- The husbands annual take home pay is $185,000 and has a 401(k) target date fund worth $650,000 with 70% in bonds and 30% in equity investments.

- The wife’s annual take home pay is $220,000 and has a Roth IRA worth $850,000 an is invested 50% in equities and 50% in bonds.

- They plan to start collecting Social Security upon retirement. The husband expects $35,000 annually and the wife $22,000.

- They currently spend $250,000 annually on living expenses and modest luxuries.

Prudent Asset Allocation Guidance

The first step required for PAA is already done! This step was to gather the facts described in the Retirement Scenario above.

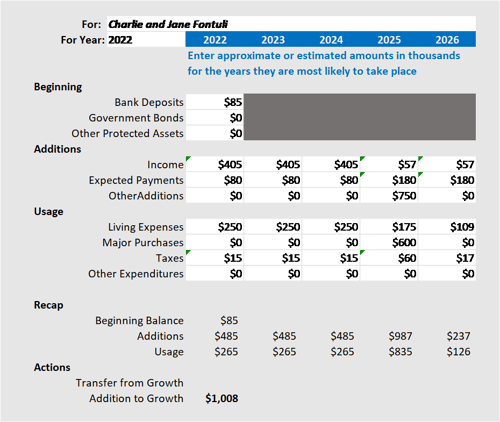

The second step is to calculate the Fontuli family needs for the next five years. The PAA Worksheet1 is used to make this calculation easy. Here are the PAA Worksheet results for the Fontuli family:

Worksheet results indicate that the Fontuli’s would be protected and be in a position for maximum growth by holding $1,008,000 in their growth component. This result reflects the buildup of assets to start retirement income in three years.

Realignment

The realignment relates to the specific actions that need to be taken to accomplish this optimum allocation.

The $1,008,000 Growth component consists of:

- $650,000 in the 401(k)

- $450,000 in the IRA

$1,100,000 Total Growth component (Note that neither the 401(k) nor the IRA can be used for the Protective component because the funds are not easily accessible.

The $450,000 in the joint investment account and $85,000 in checking and savings represent a Protective component of $535,000.

Selecting Investments

The realignment shows that funds are not invested in either Conservative or Growth components. The following changes are indicated:

- Joint investment account assets (Preservative component) are reallocated to 100% inflation protected US Treasury bonds.

- 401(k) assets (Growth) are reallocated to 100% diversified equity.

- IRA assets (Growth) are reallocated to 100% diversified equity.

NOTE: Specific investment recommendations are beyond the scope of PAA. Investors seeking help in selecting specific should engage a professional, stating the goal of maximum preservation for the Conservative component and maximum appreciation for the Growth component.

Year Two and Three

There are no changes for the next two years in our example. While inflation and market conditions will change the situation, we assume these also remain unchanged.

The buildup of Preservative assets for retirement income funding continues.

Year Four

Two major events occur this year:

- Retirement with the end of working income. Working income is replaced by:

- Social Security payments

- Annuity paying income for life

- Reduction in living expenses

- Withdrawals from Growth component, if and when needed

- Relocation to a retirement community. Net expense of relocation includes:

- Sale of existing home

- Purchase of home in retirement community

Year Five

Projections for year five are sustainable conditions with continued transfers into the Growth component:

- $237,000 of income

- $126,000 of expenditures

- $111,000 available for discretionary expenditures or additions to the Growth component.

Conclusion

In this example, using PAA produced a comfortable retirement without encroaching on the Growth component. Other circumstances that were not included here could materially change the outcome but there is sufficient provisions to cover all reasonable expectations.

%20(1)-1.png)

%20(1).png)

SUBMIT YOUR COMMENT