A Note on Causation vs. Correlation

Innumerable metrics can be used to measure an individual’s current and future financial status and well-being. In a previous article entitled, “Does Professional Guidance Improve Financial Well-Being? (Part 1)” I proposed a 5-part definition for financial well-being. Each of those prongs represented a meta-goal such as “The ability to meet day-to-day and month-to-moth expenses.” Each of these meta-goals can be analyzed and measured by various metrics, and often are as part of advisory, planning and other professional financial relationships. But when using financial well-being metrics to measure the value of professional financial guidance, we run into a valid question of causation versus correlation. Let me explain by way of example.

We know that contributing to one’s investment account is a behavior that is crucial for investment success. Investors who save and invest a greater portion of their income are poised to accumulate more assets over time (all else being equal). Let's assume we could make the assertion that an investor who works with a professional contributes on average x% more of their annual income to their investment accounts. Even if this hypothetical assertion were true, it cannot necessarily be said that working with a professional is what caused those investors to save and invest x% more. Instead of causation, we might instead have correlation. A reasonable interpretation of the hypothetical assertion above is that an investor who puts more of their hard-earned money into their investment accounts is more likely to hire a professional for financial guidance. This isn’t to say that the latter interpretation is of no value, but it’s fundamentally different than a causal link.

To confront the causation question, I tried to think of the real root cause of financial well-being.

And this is where the idea of ALL ELSE BEING EQUAL needs to be addressed again. It would be naïve to ignore the fact that more money can be a substantial root cause of greater financial well-being. Not everybody is playing the same game or keeping the same score. Individuals with better jobs, better luck, better skills, etc. will often have more income or assets to make financial well-being a more navigable pursuit. These are factors that are generally outside the control of the financial professional, and often times outside the control of the investor. However, when discussing causation versus correlation, it is essential that we are looking at investors in similar economic circumstances or else there will be no way to escape the possibility of correlation stemming from wealth (people with more money are more likely to have better financial well-being metrics and are also more likely to hire a financial professional).

After I came to that cold, hard reality check I realized that what we’re really after are the root causes of optimizing financial well-being, given the circumstances that are presented (i.e. income, existing assets, expectancies, necessary expenses, the unforeseen and uncontrollable). After all, the financial guidance we're talking about isn't going to help someone earn a higher salary or prevent their roof from needing repair.

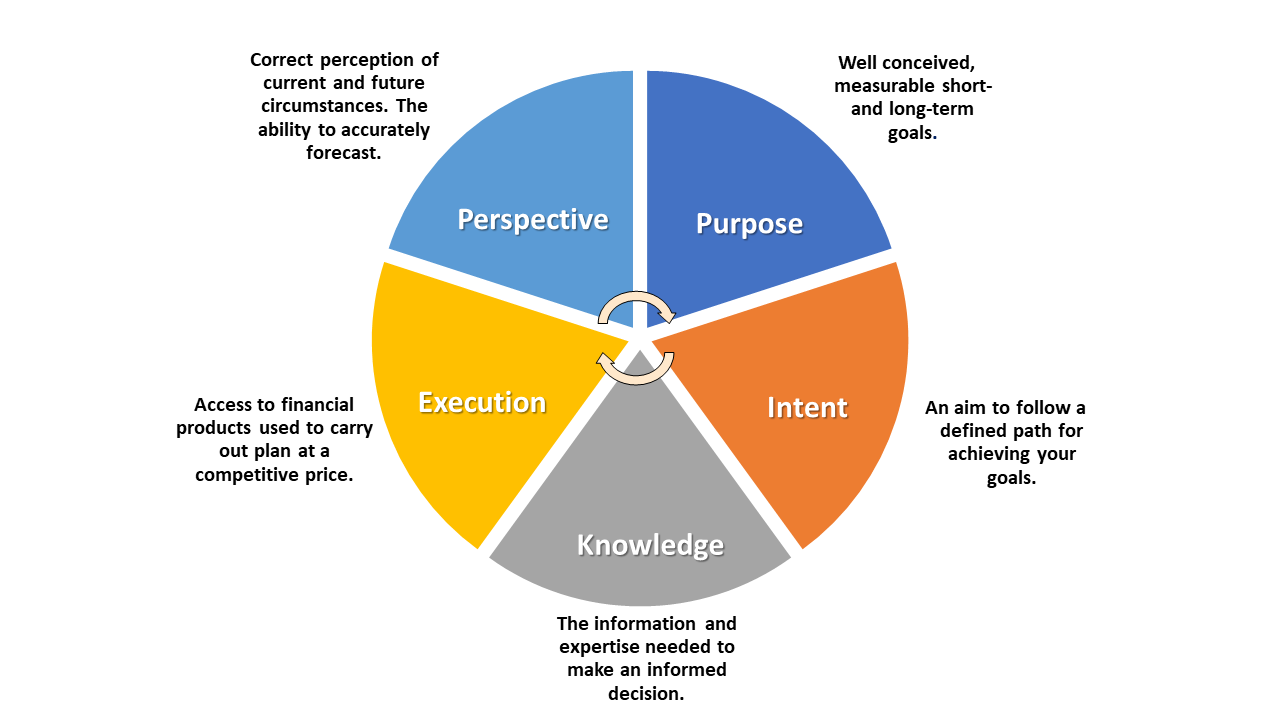

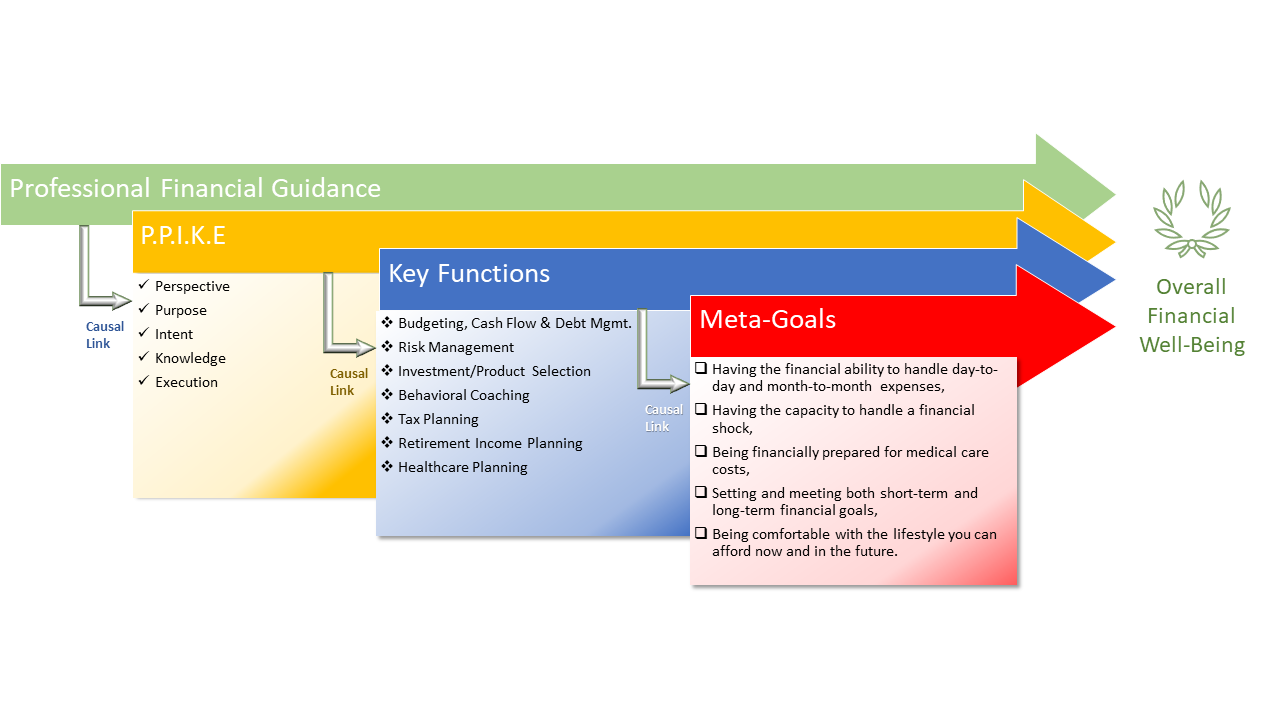

Each time I identified a potential root cause, I was able to peel back another layer until I finally had no more layers to pull. After wiping the tears from playing with my proverbial onion, I was left with just 5 root causes for optimizing financial well-being: Perspective, Purpose, Intent, Knowledge and Execution (PPIKE). Whether an investor is working with a professional or on their own, their level of PPIKE is the root cause of optimized or impaired financial well-being.

With respect to PPIKE, we don't run into the same causation versus correlation problem. In this situation, I think we all feel a lot more comfortable saying that greater perspective, purpose, intent, knowledge and execution is a cause of greater financial well-being. If we feel comfortable with the causal link between PPIKE and positive financial well-being metrics then we can extend that causal link to reach the role of the financial professional. To do so, we merely have to create the causal link from professional financial guidance to PPIKE. We then have a clear causal link from the professional guidance to positive financial outcomes.

With this new paradigm, we can look at the value of professional guidance differently. We start with how the professional relationship enriches PPIKE with respect to any of the key functions. For example, if we wanted to examine the effect of a professional relationship on an individual's budgeting and cash flow PPIKE, we might ask the following questions:

- How will this relationship provide the individual with a more accurate perspective of his/her current budget and cash flow? (Perspective)

- How will this relationship provide the individual with a better forecast of future budget and cash flow needs? (Perspective)

- How will this relationship help the individual construct a well-conceived budget and cash flow goal? (Purpose)

- How will this relationship help to measure if budget and cash flow goals are being met? (Purpose)

- How will this relationship help the individual create a specific plan for achieving the budget and cash flow goals? (Intent)

- What knowledge and experience does the relationship provide to optimize the goals set, plans created and decisions that are made related the individual's budget and cash flow? (Knowledge)

These are just some of the values we can draw from applying PPIKE to budgeting and cash flow. We could easily tease out more questions and then multiply them for all relevant key functions. The result would be literally hundreds of potential root causes of financial well-being tied directly to the values provided by the professional. So as a financial professional, the next time someone asks you what you can do for them, the response might need to be, "how much time do you have?"

.jpeg)

SUBMIT YOUR COMMENT