How much is financial guidance worth?

This is a question I've received countless times from stakeholders across financial services. They want to know because their investors want to know, and because understanding the value is the key to maximizing it. As an industry, there seems to be a sneaking suspicion that professional guidance provides more value than the public generally recognizes, but how does one go about measuring such a thing?

Measuring that which is difficult to measure is DALBAR's specialty, so let's break some ground as to how we can measure the value of professional guidance. First, we need to survey the land and define what we mean by "professional guidance." There are many different financial professionals, each offering unique services and value. I've used the term "professional guidance" as a catch-all for the most common financial professional relationships today, such as investment advisors, wealth managers, registered representatives, and financial planners. Many of the services, titles and values offered by these professionals overlap, but some are unique to their respective relationships. For example, a relationship with a wealth manager may have little effect on budgeting or debt management, while working with a financial planner may have less impact on investment returns. Once we define the services provided by a professional, we’ll have a better idea of where to look (and where not to look) for value.

Next, I would like to unpack what we mean by value. For an investment advisory relationship, an investor may be tempted to measure the value by comparing their investment return to peers’ or to a certain benchmark. This would be a mistake for many reasons DALBAR has documented for the past 30 years. While superior investment returns would logically have a strong causal link to the professional guidance involved, investment performance is by no means a dispositive measure of the value derived from any professional financial relationship.

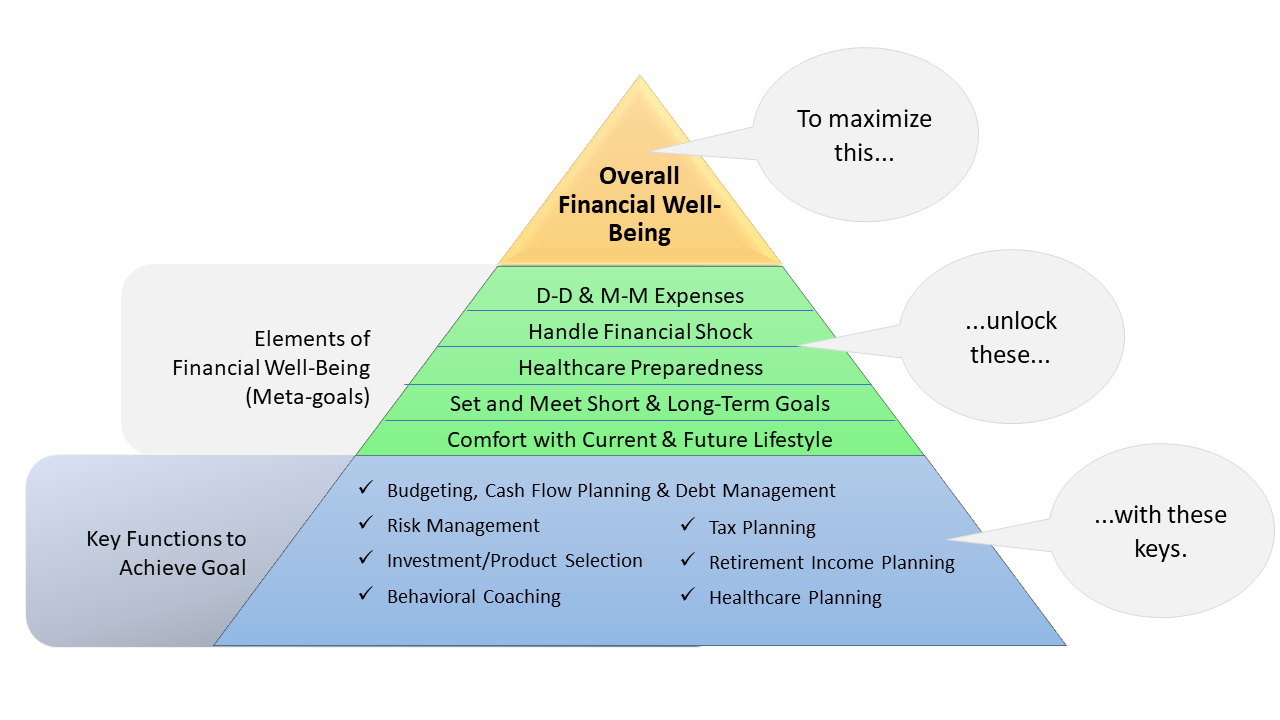

I would argue that the best way to measure the value of a professional financial relationship is by its effect on overall financial well-being. This casts the largest net to capture the effects of many dynamic variables. The Consumer Financial Protection Bureau (CFPB), defines financial well-being rather broadly as (i) having control over day-to-day and month-to-month finances, (ii) having the capacity to absorb a financial shock, and (iii) being on track to meet financial goals.[1] The Milken Institute expanded on that notion to define what it calls Lifetime Financial Security.[2] I like the Milken Institute’s definition better because it addresses both short and long-term goals, medical care costs and lifestyle considerations.

For the purposes of this discussion, we will use a 5-prong definition of financial well-being that blends the CFPB and Milken Institute definitions:

- Having the financial ability to handle day-to-day and month-to-month expenses,

- Having the capacity to handle a financial shock,

- Being financially prepared for medical care costs,

- Setting and meeting both short-term and long-term financial goals,

- Being comfortable with the lifestyle you can afford now and in the future.

All value derived from professional financial guidance should reside in one of the 5 prongs above. I would go further to say that any measurement of value that does not look toward all 5 aspects of financial well-being is not a complete and accurate account of the value derived.

The five prongs of financial well-being can be thought of as meta-goals in that they are self- referential to more specific financial goals (a goal to achieve a goal). A specific financial goal might be “I want to save $2M by the age of 60.” This would relate directly to achieving the meta-goal of “setting and meeting short- term and long-term financial goals” which directly relates to the supreme goal at the tip of the pyramid (the meta-meta-goal if you will) of maximizing financial well-being.

The meta-goals are achieved through 7 key functions, which are broad enough to generally represent the whole of what the financial services industry has to offer. The vast majority of professional financial guidance provided to investors today will fall squarely or partially into one or more of these 7 categories:

- Budgeting, Cash Flow Planning & Debt Management

- Risk Management

- Investment/Product Selection

- Behavioral Coaching

- Tax Planning

- Retirement Income Planning

- Healthcare Planning

Perhaps this pyramid should be upside down in that the key functions help to achieve the meta-goals, which trickle down to overall financial well-being. To measure value, we have to identify which of the key functions are in scope and how each contributes to the 5 prongs of financial well-being. Only when considering the full spectrum of financial well-being can we begin to understand and measure the value of professional financial guidance.

Go to: Does Professional Guidance Improve Financial Well-Being (Part 2)

[1] Genevieve Melford et al., Financial Well-Being in America, (Consumer Financial Protection Bureau, September 2017), https://files.consumerfinance.gov/f/documents/201709_cfpb_financial-well-being-in-America.pdf.

[2] Cheryl L. Evans, JD, and Mairead Treanor, Shifting the Retirement Paradigm: Moving Towards Lifetime Financial Security

(Milken Institute, August 2023), https://milkeninstitute.org/sites/default/files/2023-8/AFrameworkforActionStrategiesforEnhancingLifetimeFinancialSecurityFINAL.pdf. (Definition includes (1) having the financial ability to pay reoccurring monthly expenses, (2) having the funds to pay for adequate housing, (3) having the ability to absorb a financial shock, (4) setting and meeting both short term and long-term financial goals, (5) having a tax advantage savings plan to save for the end of your traditional working life, (6) being financially prepared for medical and long-term care costs, and (7) being comfortable with the lifestyle you live and can afford).

.jpeg)

SUBMIT YOUR COMMENT