|

Financial Professionals have a difficult task of complying with regulatory requirements while also doing their best to act in their client's best interest. As an expert, there are a lot of factors to take into account in ultimately meeting client goals. Putting the investor's interest first is more challenging than what one might think.

Of course, putting the investor’s interest first requires that the professional knows what their best interests actually are. This should be an ongoing process to understand the varying needs and situations of individual investors. It is important the professional asks the right questions that lead to finding out what is important to each investor's unique situation.

In order to have a better understanding of the disconnect between the financial professional and the investor, DALBAR conducted a survey that asked a representative sample of investors to report what they considered to be in their best interest. In aggregate the survey showed which interests investors considered most important, which produced a scoring by importance of the interests.

The study also helps fiduciaries with the one of the most vexing conundrums; the intersection of an investor’s best interest and the potential cost of meeting their expectation. The Best Interest Survey sorts through this puzzle by examining the interests that are most/least important to investors as well as their desire for low costs.

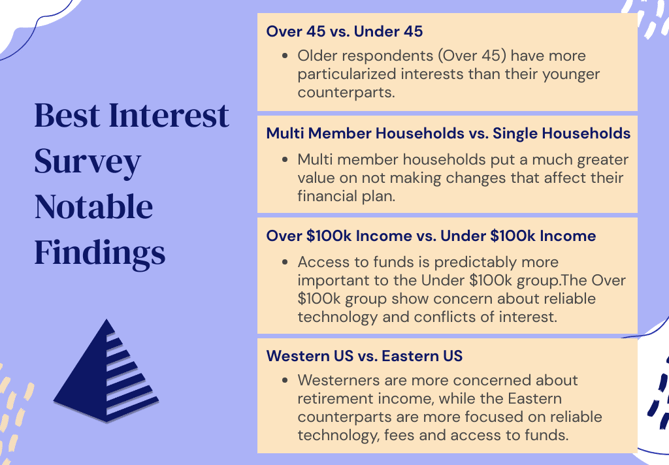

The Analysis of the Best Interest SurveyThe 2021 Best Interest Spread Analysis examined the factors investors feel are most important to their best interest and how those interests vary based on age, gender, geography and income.

The major conclusion from this work was that interests as defined by investment professionals were not even close to what investors considered to be in their best interest. |

Best Interest RecommendationThe major finding requires a reevaluation of practices and procedures being used and being considered to meet the goal of acting in the investor's best interest. The missing first step is finding out what the best interests are and then developing the practices, procedures and systems to meet the goal.

Adopting a Best Interest policy will also materially change business costs and will require funding. On the other hand, additional revenue and cost savings are achievable, as new practices are added and unnecessary ones removed.

|

Best Interests are DiverseThe Best Interest Analysis illustrates how diverse the best interests of the population are. For there to be any hope of achieving the promise of acting in an investor’s best interest, it is essential to examine the investor’s view of what is in their best interest.

Find out more about the Best Interest Survey and view an analysis of the results here.

|

%20(1)-1.png)

%20(1).png)

SUBMIT YOUR COMMENT